IA’s Pricing and Promotions Analysis identifies the trends and changes in pricing and promotions across various categories by tracking and analyzing publicly available data. The analysis provides insights about promotions at a category level and across different price points. It also uncovers the pricing strategies adopted by brands across categories as a response to the current market conditions.

IA's

Insights on Pricing & Promotions -

Athleisure & Footwear

Home »

As Consumers become cautious about their spending habits, promotions seemed to have bottomed out:

Footwear and Apparel prices have increased by 4.5% and 5% in May 2022 over last May according to the Consumer Price Index data. Due to a significant increase in the cost of living, consumers have started feeling the pinch and this is reflecting in a lower consumer confidence. This may force them to spend wisely and lower their discretionary and impulse spends and migrate to lower priced brands and pursue discounts. Considering the lower consumer confidence, we foresee promo intensity to increase in coming months.

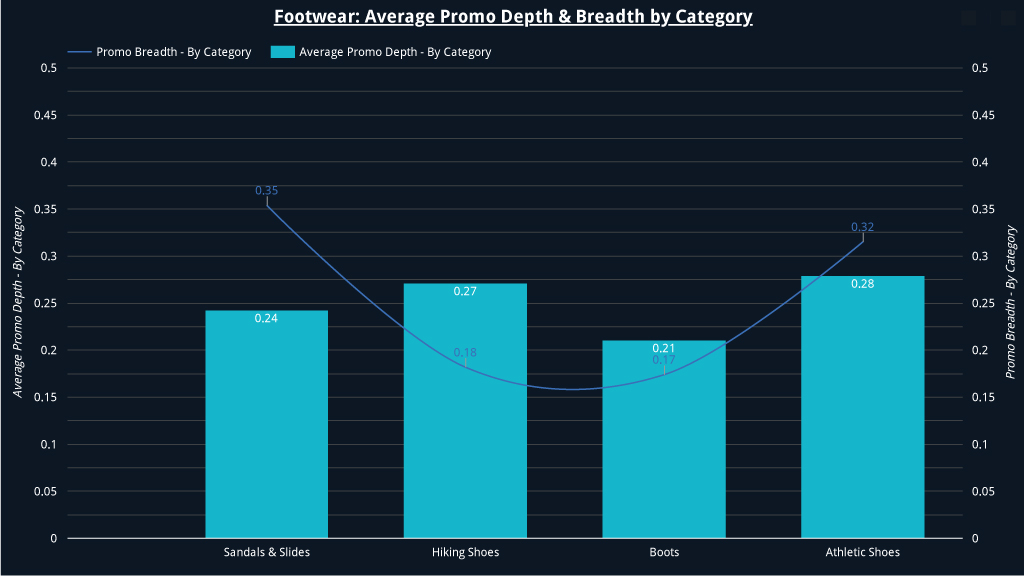

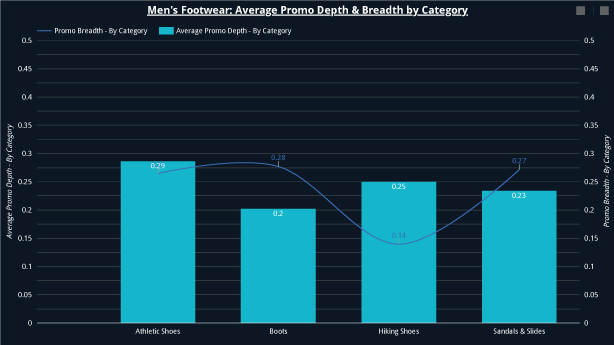

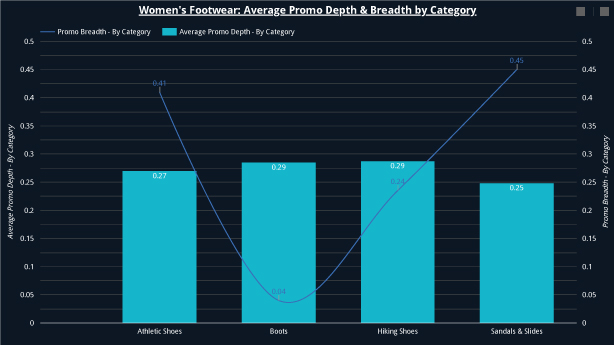

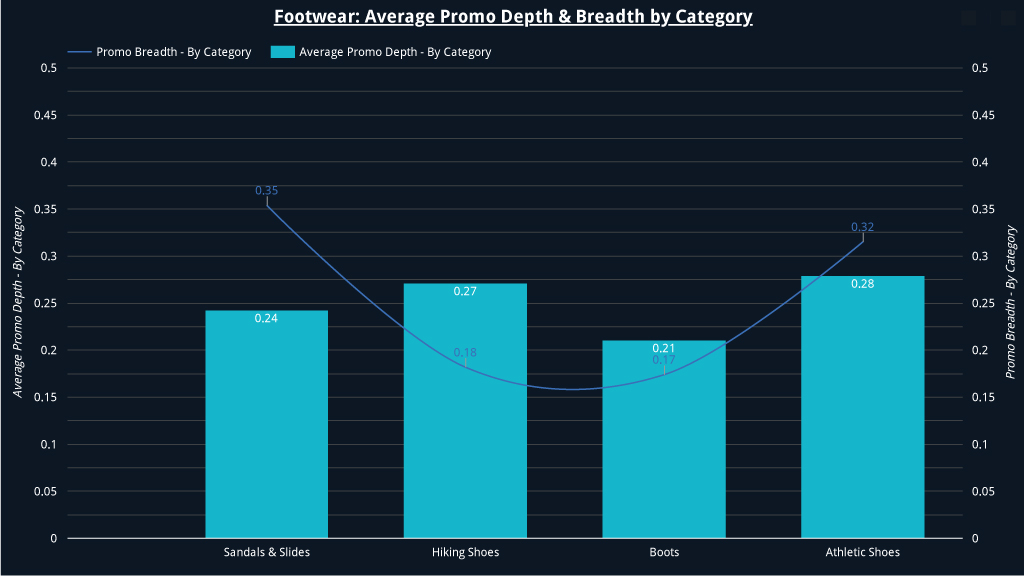

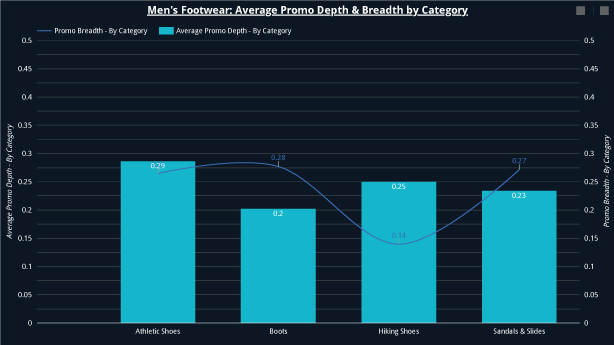

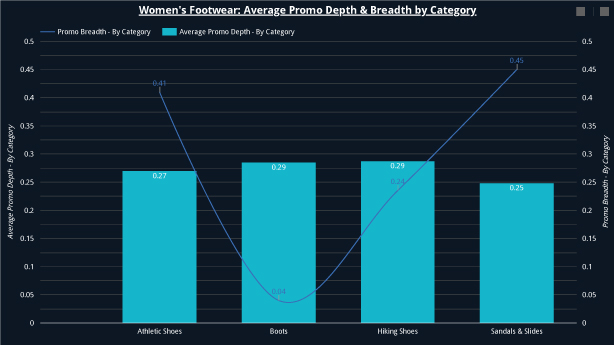

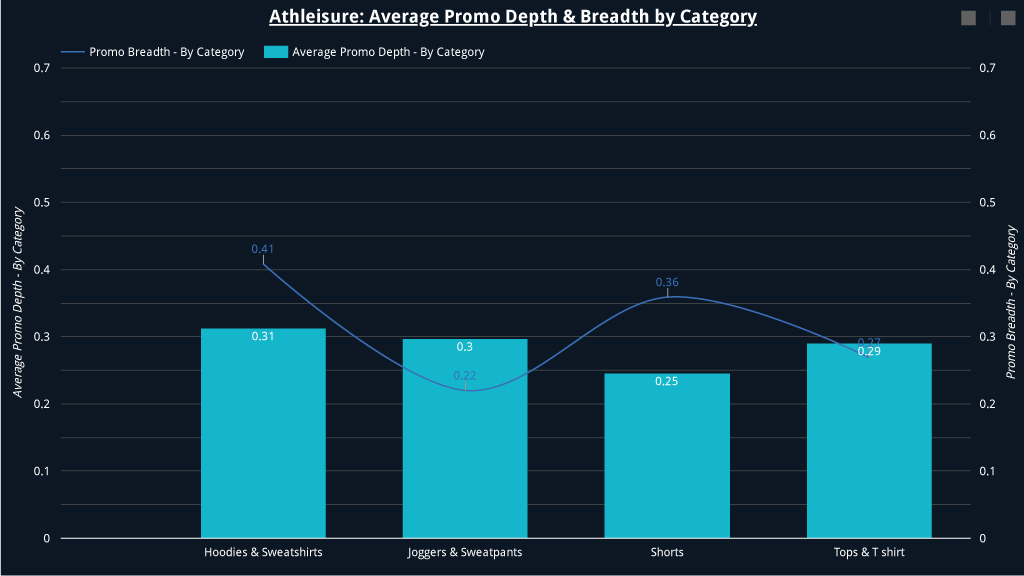

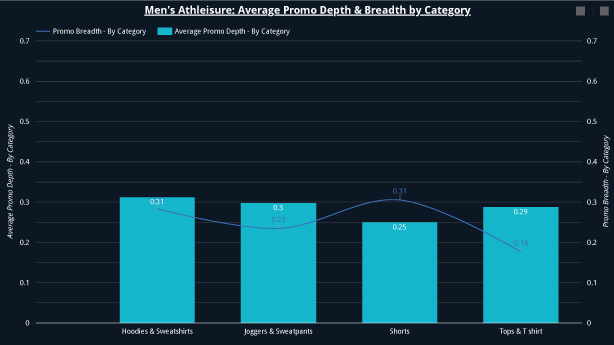

Retailers and brands are trying to adapt to different pricing and promotional strategies to keep their products affordable to their target consumers. These strategies vary by depth and breadth across each of the subcategories. Across Athleisure and Footwear, brands are maintaining an average discount of ~25-30% on around ~30% of their product to ensure their products remain affordable for the consumers.

For Footwear, the average discount on men’s wear is lower by 2% to 9% and the promo breadth is higher by 10% to 18% (except for Boots). In Athleisure,while the average discount is same across men and women, the promo breadth is higher for women’s wear for all categories between 12% to 33%

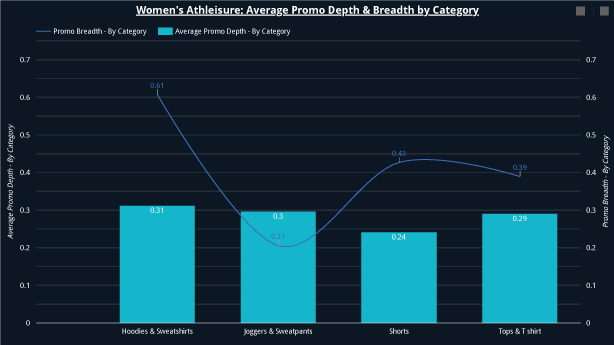

In Athleisure, while the average discount is same across men and women, the promo breadth is higher for women’s wear for all categories between 10% to 30% (except for joggers and sweatpants where it is 2% lower)

Brands are trying to make their merchandise affordable while maintaining their price perception

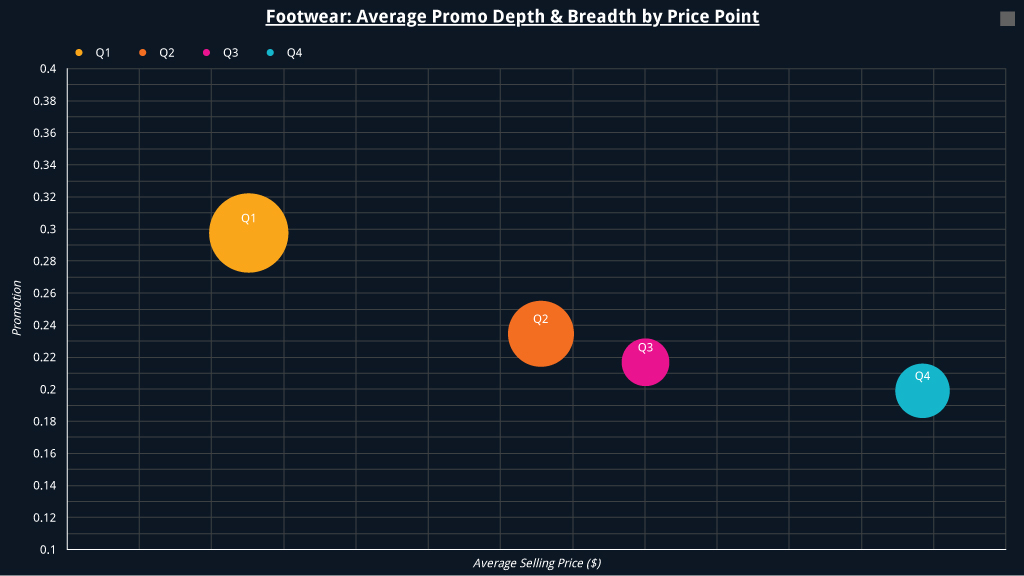

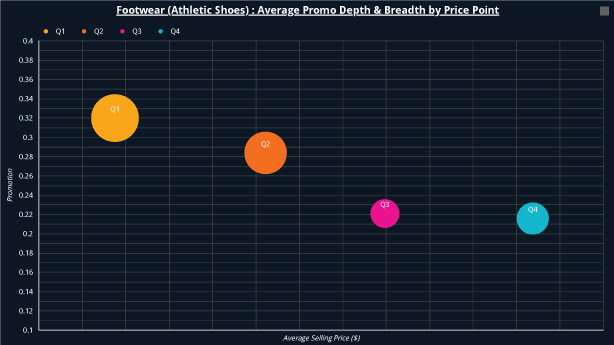

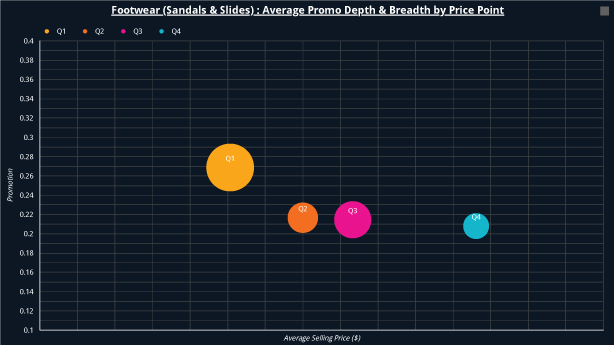

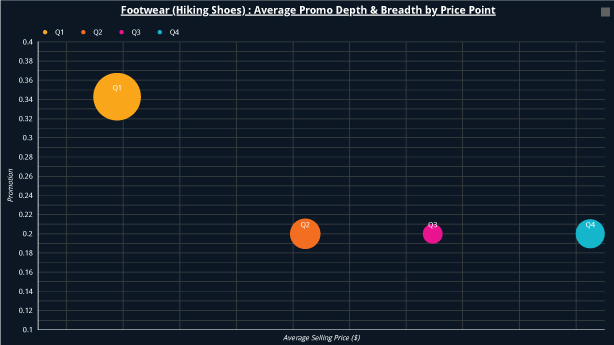

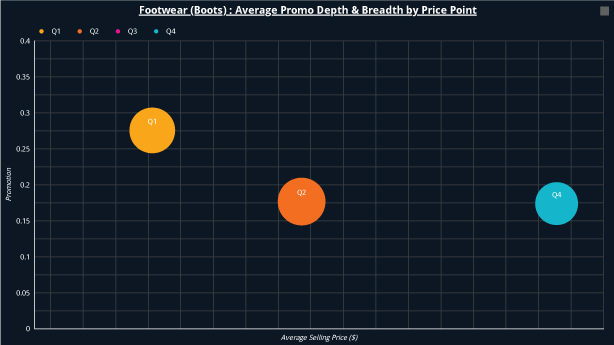

Amid tumbling consumer confidence and lower affordability, brands are offering on avg. ~10% more discounts on the lowest-priced products (Quartile 1) than the highest-priced products(Quartile 4) & the breadth of the promotions is higher by ~20% for products in Quartile 1 as compared to products in Quartile 4 for Footwear.

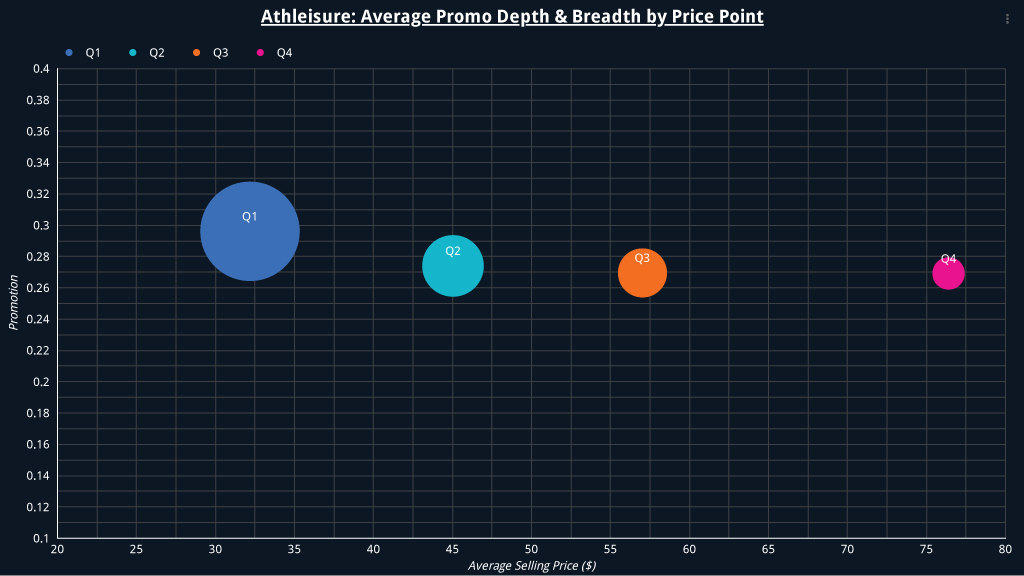

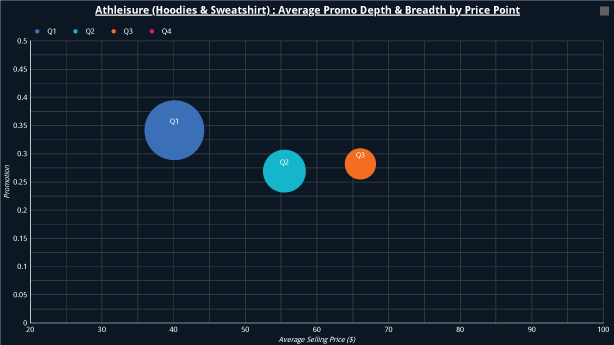

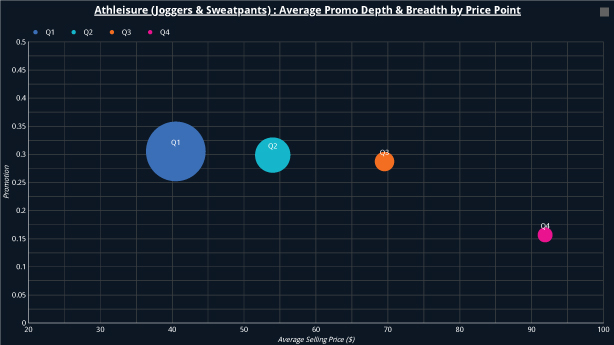

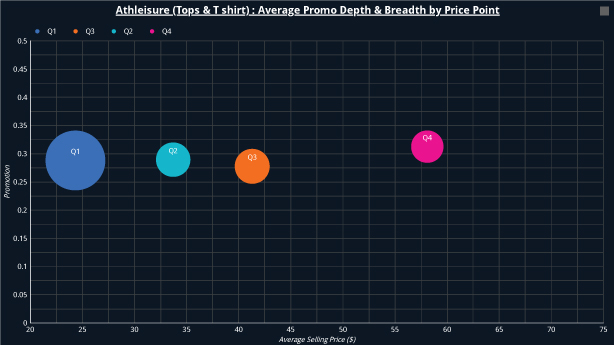

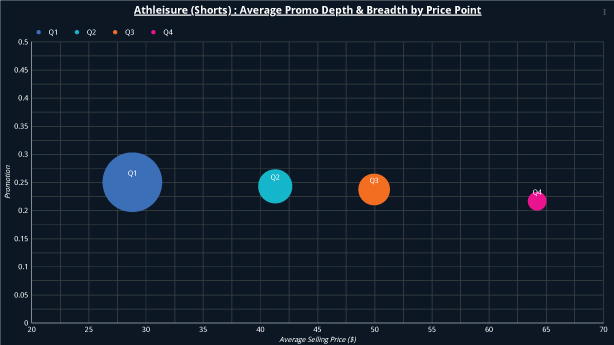

A similar trend can be seen in Athleisure where, while the average discount being offered is higher by ~3% on the lowest prices products (Quartile 1) than the highest-priced products(Quartile 4), the breadth of the promotions is higher by ~60% for products in Quartile 1 as compared to products in Quartile 4

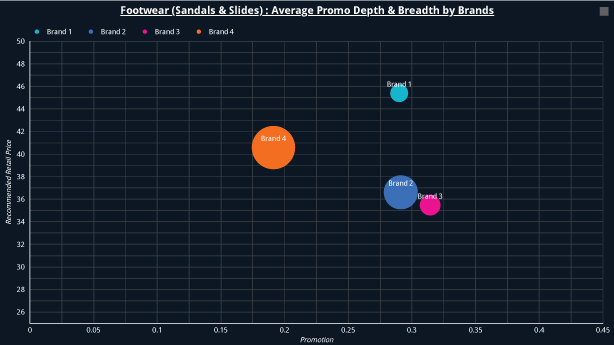

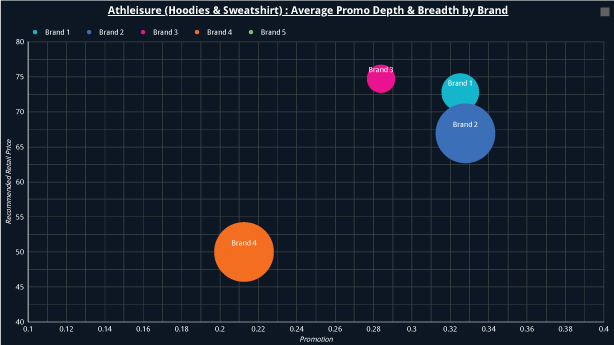

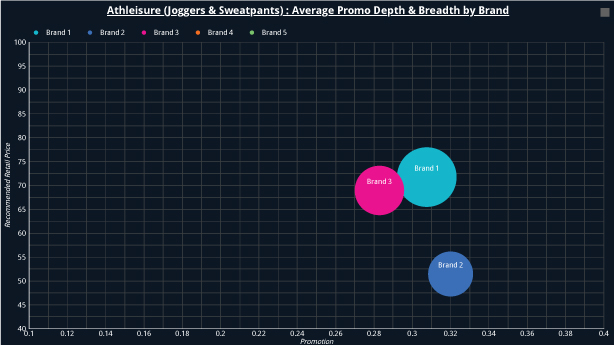

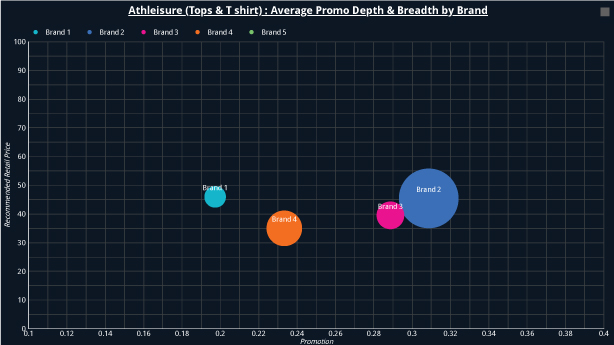

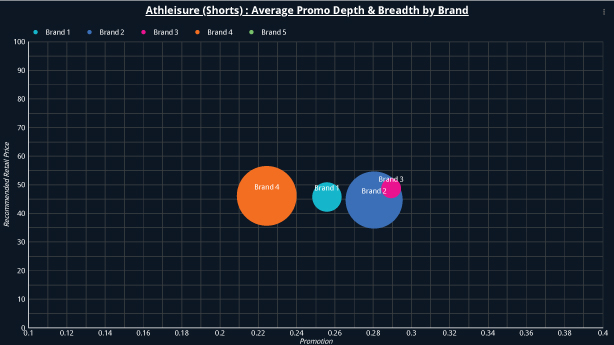

Brands are adopting different pricing/promotion strategies across key value categories to garner higher wallet share

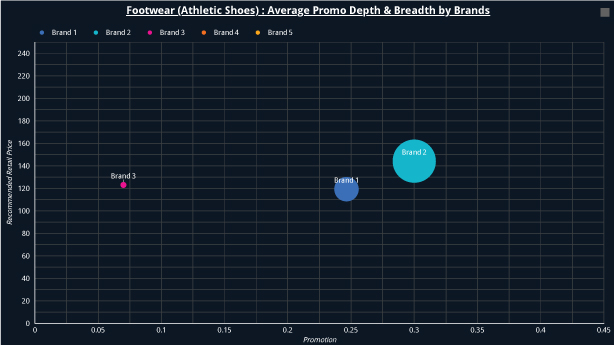

For Footwear (sub category - Athletic Shoes) while the recommended price for Brand 2 is higher by ~21% than Brand 1, it offers a deeper average discount (5%) on a broader set of products (90% for Brand 2 vs ~30% for Brand 1). Brand 4 on the other hand is providing lower than category discounts on all of its products in certain categories.

In Athleisure, across categories, Brand 2 is providing deeper discounts on a broader range of its products as compared to other brands with a few exceptions. Brand 4 on the other hand is providing lower than category discounts on all of its products in certain categories. Brand 5 does not offer discounts on any of their products.

Contact Us

Let’s understand some of the challenges you are facing and how we can help alleviate them.

Contact : +1 856-666-1443

Email : [email protected]

Driving ROI through

AI Powered Insights

We are led by a team with deep industry expertise . We believe in “Better decisions with AI” as the center of our products and philosophy, and leveraging this to empower your organization

REQUEST DEMO