Analysis: Amazon Prime Day 2023

We analyzed Amazon Prime Day promotions across 11 categories over the last five years.

What we learned will help you prepare for the 2023 holiday season.

Home » Resources » Industry Analyses »

Prime Day Promotions Analysis: Why We Do It

As an AI-driven retail data analytics firm, we’ve analyzed Amazon Prime Day 2023 sales to discern the causes, isolate the effects, identify the trends, predict the future—in this case, the upcoming 2023 holiday season—and ensure our clients are able to take full advantage of our learnings and evolving, real-time conditions.

Prime Day Promotions Analysis: Numbers Talk. Loudly.

The 2023 Amazon Prime Day sale was Amazon.com’s largest ever1. Over two days (July 11-12):

- Amazon.com customers worldwide bought more than 375 million items.

- Amazon.com customers in the U.S. spent about $12.7B2.

That is a lot of shopping. Consumers, weary of inflation, were primed (as it were) for bargains and Amazon Prime Day 2023 delivered, offering more deals than any previous Prime Day.

Notably, however, the average year-over-year (YoY) order size barely budged—increasing from $52.26 to $54.05, according to Numerator market research firm3—and, based on data drawn from the Consumer Price Index, more than 80 percent of that increase was due to inflation.

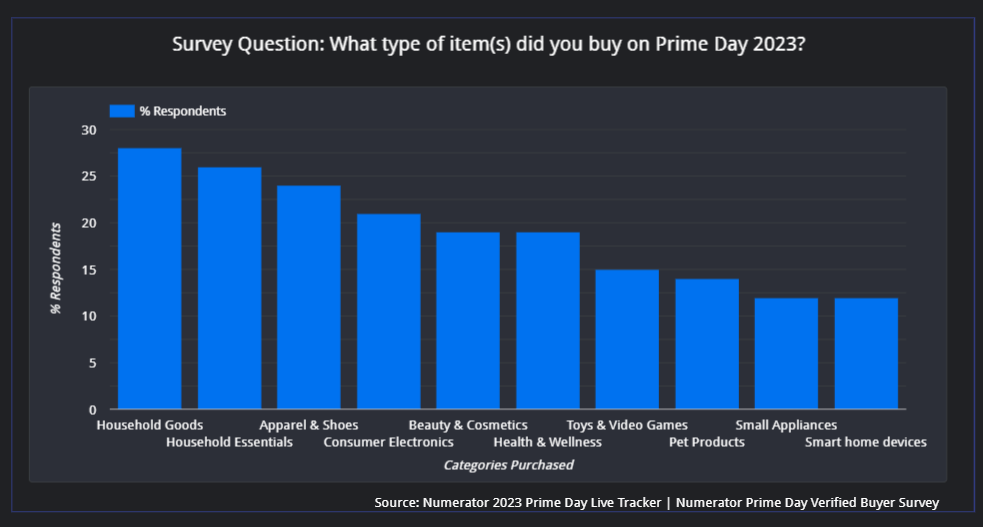

Numerator also notes that consumers said their top two categories were Home Goods and Home Essentials. Taken together, Numerator’s data points indicate consumers at mid-year 2023 are still feeling constrained, especially when it comes to spending on discretionary items.

Prime Day Promotions Analysis: A Mixed Bag for Consumers

So what did we learn from Amazon Prime Day 2023?

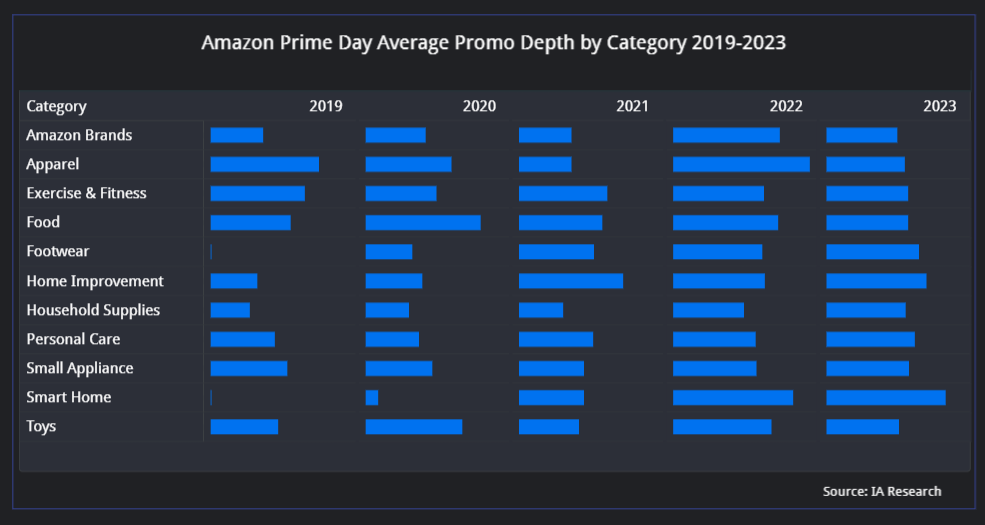

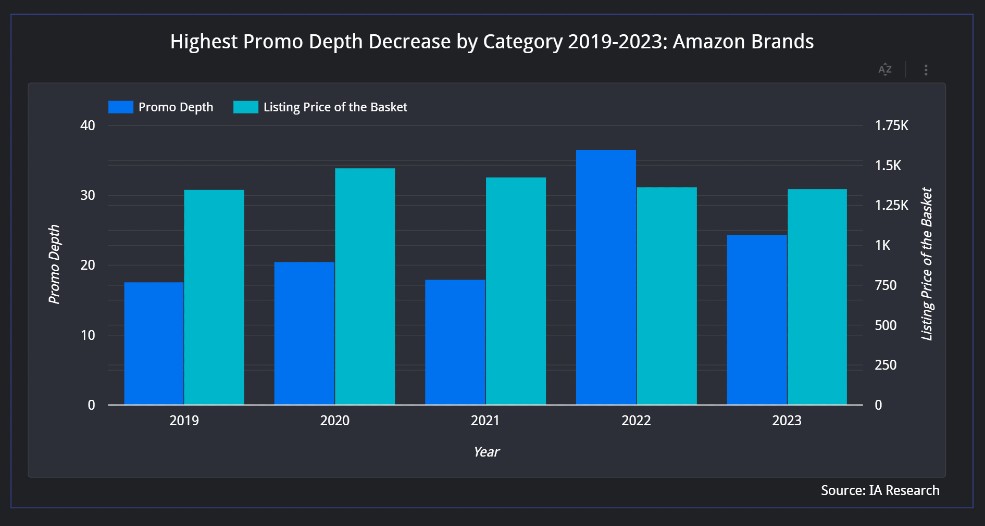

Promo depth for most categories—such as Smart Home (more than 40 percent), Small Appliances, Footwear, and Exercise & Fitness—was largely in line with last year’s discounts. Essential Goods were discounted more deeply YoY while categories that suffered from excessive discounting last year corrected back to normal.

As noted, discretionary spending appeared restrained due to consumer skittishness (over high inflation and interest rates, macroeconomic uncertainty, etc.). Amazon and its vendors chose to apply their deepest discounts to Household Supplies, Home Improvement, and Personal Care items—an increase between 5 to 10 percent over last year. Base prices for the Home Improvement category increased by more than 30 percent while Household Supplies and Personal Care categories stayed mostly flat.

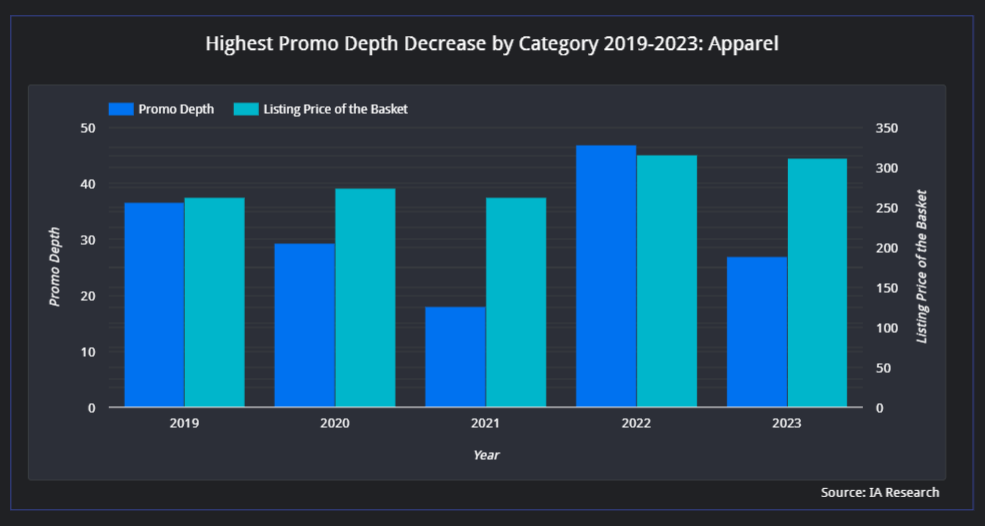

The COVID pandemic-induced inventory glut has largely dissipated, enabling apparel discounts to revert to the mean: Apparel promo depth dropped ~40 percent compared to Prime Day 2022, albeit on very high base prices, which stayed fairly flat after their sharp, more than 20 percent increase last year.

The Impact Analytics Fashion Promotion Index, which captures the depth and breadth of promotions in Footwear, Athleisure, and Regular Wear, and is updated every two weeks, corroborates these findings: Apparel discounts have been lower this year, with Regular Wear down 12 percent.

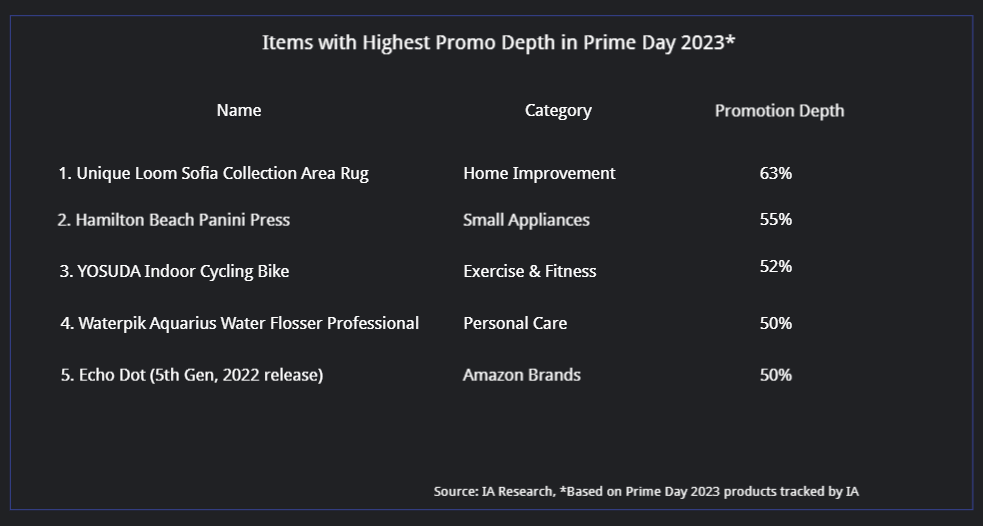

Many top-selling items across categories were heavily discounted.

Amazon Prime Day 2023 and This Holiday Season

Our analysis strongly suggests that, despite cooling inflation, a still-rosy employment picture, and the U.S. Federal Reserve’s fabled “soft landing” for the economy nearly in hand, consumers will continue focusing their spending on nondiscretionary items—and retailers will continue targeting those items for discounts.

Of course, there’s still a lot yet to process this year. Variables and unknowns include:

- Amazon sales events: Amazon may—or may not—hold another consumer behavior-changing event, like its October 2022 Prime Early Access Sale.

- The war in Ukraine: The war recently forced Ukraine to shut down grain shipments with implications for the global food supply; things could take a variety of ugly turns ahead.

- The 2024 U.S. presidential elections: The campaign season is looking increasingly volatile with the frontrunner for the Republican nomination fielding multiple indictments.

- Interest rates: Going up?

- Inflation: Coming down?

All of which leaves consumers cautious and retailers uncertain.

As conditions shift or utterly transform, retailers must be prepared to make quick, tactical changes to their pricing and promotions strategy.

Choose the Impact Analytics Pricing War Room for the Holidays

Do pricing and promotions right and you’ll maximize your profitability this holiday season.

The Impact Analytics Pricing War Room offers five customized pricing services and a dedicated team to run things. Take advantage of our expertise, hands-on tactical support, and 20,000+ predictive AI models, harnessing the maelstrom of internal and external signals to power a successful pricing strategy.

Check out the Impact Analytics Pricing War Room.

References: 1Amazon | 2Adobe | 3Numerator

Driving ROI through

AI Powered Insights

We are led by a team with deep industry expertise . We believe in “Better decisions with AI” as the center of our products and philosophy, and leveraging this to empower your organization